Create a Power of Attorney (POA) in Canada

Knowing that your affairs will be taken care of when you can’t take care of them yourself is reassuring.

Whether you become permanently incapacitated or just temporarily unable to make important decisions, having a Power of Attorney that allows a family member or other trusted advisor to make sound medical and financial decisions is a critical part of a comprehensive estate plan.

View Plan Details >

Types of Powers of Attorney

A Power of Attorney is a legal document that allows someone to act on your behalf.

- An Enduring Power of Attorney remains in effect if the principal becomes incapacitated and can be used to allow your agent to manage all of your affairs.

- An Ordinary Power of Attorney is normally active for a period of time until the donor is incapable of acting for themselves.

- A Special or Limited Power of Attorney is typically used for one-time financial transactions.

- A Springing Power of Attorney becomes effective if you become incapacitated or are no longer able to make decisions. An Immediate Power of Attorney grants the power to the attorney-in-fact or agent immediately upon execution of the document.

Depending on your needs, your provider lawyer can help you understand which type of Power(s) of Attorney you may need. Each province has laws governing Powers of Attorney. Join LegalShield today and contact your provider law firm for assistance.

Pick The Best POA For Your Needs

While a quick Google search may make it seem obvious which type of Power of Attorney you need, there can be legal and medical factors you’re not aware of that warrant creating one type over another.

Also, if you want to create a Power of Attorney to be used much later in life that can flex as circumstances change, it’s important to consider scenarios that may not be clear to you at this time.

The best way to pick the right type of Power of Attorney is to work with an experienced lawyer to develop a comprehensive strategy for now and in the future.

Rest Easy When It’s Done Right

Using a Power of Attorney, you can appoint any competent person over the age of 18 to be your lawyer-in-fact. You may also appoint financial institutions. However, keep in mind that this is a large responsibility to hand over to an individual. It’s critical that you choose thoughtfully and wisely.

Laws vary from province to province, and what seems like a small legal loophole can make legal documents unenforceable. The last thing you want is to have a bank or medical institution refuse to honour your Power of Attorney right when you need it most. To make sure your Power of Attorney is legally binding, work with a lawyer that has knowledge of the laws in your province. Doing it right provides peace of mind.

Get a Will Within 5 Days

Creating a Will on your own can be overwhelming and time-consuming. Also, without the help of a lawyer, you may never be sure you followed the law correctly and that a court will honour your wishes. Most lawyers charge an average of $1,500 dollars to draft a basic Will and estate plan. There is a better option.

Get a personal legal plan from LegalShield starting at $29.95 per month and you get a Will, Living Will/Advanced Directive and Power of Attorney created by an experienced estate planning lawyer within 5 days of completing our Will Worksheet. It’s the simple, stress-free way to cross this critical item off your task list.

“I had no idea what a Power of Attorney was until my son’s grandmother asked me to get one made while he’s out of state with her. I just want to thank LegalShield for providing me with that document for free because I asked the attorney how much would this have been outside of LegalShield, she said $800 for consultation $400 for sending information to her and $1,400 for the document being created. I just saved $2,600. That’s why I love LegalShield.”

—Shanikque H.

LegalShield Member and Independent Sales Associate

How it works

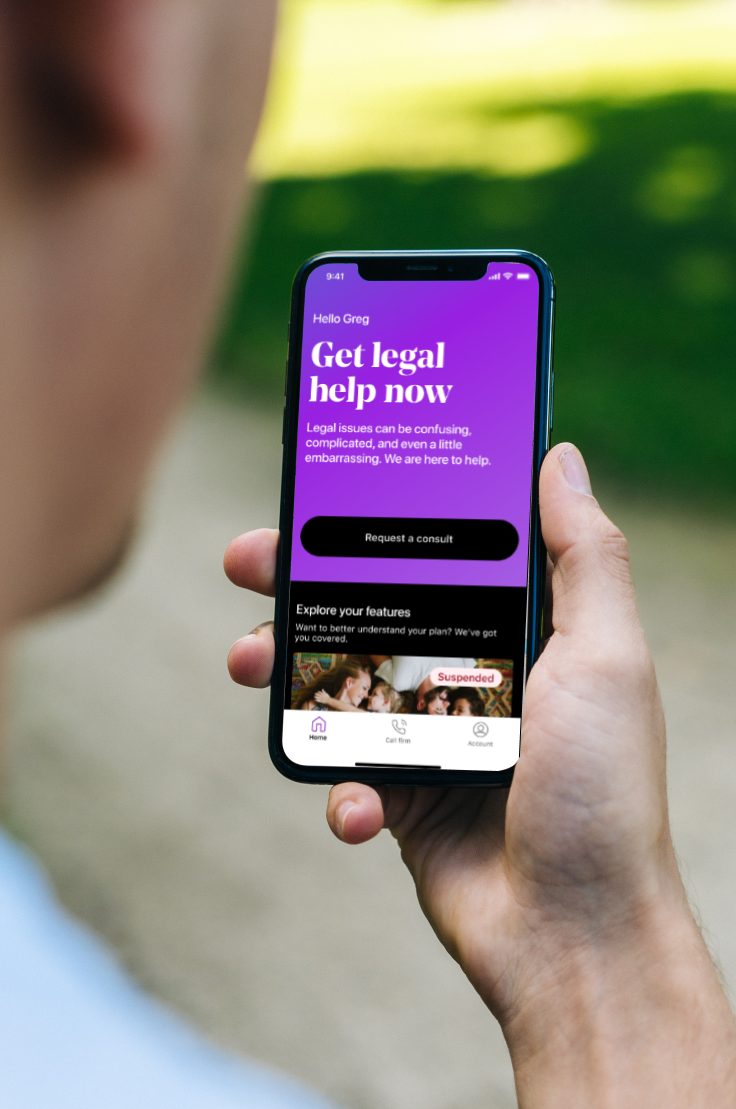

Legal issues can be confusing, complicated, and even a little embarrassing. Save time, save money, and protect yourself and your family with a legal plan today. Here’s how it works.

1Become A Member

Sign up for your Personal Legal Plan, and then head to accounts.legalshield.com to set up your account. Be sure to add your spouse and dependant children.

2Download LegalShield App

Download our app, it’s like having a lawyer in your pocket. Our customer service agents are available 24/7 to help guide you.

3Get Legal Help

From the app you can choose to call your law firm, submit a traffic ticket, start your Will or other documents, request emergency legal help, and more. It’s that easy.

Estate Planning is Easy with Help from LegalShield

Personal LegalShield Plans Start at Only $29.95 Per Month

Dive Deeper into Estate Planning

Explore More Topics